.

Menu

Understanding and aligning with business requirements is essential for businesses, as industries with longer cost cycles could experience higher average assortment intervals. The accounts receivable assortment interval is a metric closely scrutinised by investors. A well-managed and environment friendly assortment interval enhances investor confidence, reflecting positively on the company’s financial administration practices and skill to generate sustainable returns. Monitoring the collection period allows businesses to identify potential points early, enabling proactive measures to mitigate risks https://www.kelleysbookkeeping.com/ and avoid financial setbacks. Once we all know the accounts receivable turnover ratio, we are in a position to do the common collection interval ratio. Businesses base their credit score limits and credit score periods on their historical information such because the account receivable assortment interval.

In conclusion, whereas the gathering interval is a singular metric, it paints a broader picture of an organization’s financial well being. If not managed properly, an extended assortment interval can point out potential points in account receivables and credit insurance policies, considerably impacting a company’s cash circulate and total monetary well being. Regular monitoring and well timed interventions are key to sustaining efficient collection processes and guaranteeing smooth business operations. The assortment period, also called the days’ sales in accounts receivable, is a vital monetary metric that businesses use to evaluate their monetary health. It measures the common time it takes for a company to transform its accounts receivables into money.

This would indicate receivables collection period extra efficient, streamlined cash move and better liquidity, giving an organization confidence to make quicker purchases and plan for bigger expenses. Sometimes, the shorter your assortment interval, or the lower your DSO/higher your accounts receivable turnover, the better. A relatively short common collection period means your accounts receivable collection staff is turning round invoices rapidly and every thing is working smoothly. Longer assortment periods could also be as a result of clients that have financial issues or broader macroeconomic or industry dynamics at play.

To understand the gathering period in context, investors may additionally take a glance at metrics like the Days Gross Sales Outstanding (DSO). This benchmark measures the average variety of days it takes for an organization to collect fee from its customers after a sale has been made. By comparing the gathering interval with the DSO, traders can get a clearer picture of how the company performs in opposition to its industry peers by way of collections effectivity. Primarily, it measures how effectively an organization manages its receivables and credit score policies. Establishing a transparent understanding of your collection interval can act as the first line of defense towards potential financial difficulties, as irregularities might be a sign of deeper points. On the other hand, a shorter collection period may signal that the corporate maintains a strict credit score coverage, perhaps because of prioritizing money move stability.

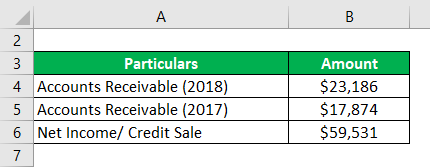

Whereas the ideal collection period varies throughout industries, a shorter assortment interval generally indicates a extra favourable situation. For the formulas above, common accounts receivable is calculated by taking the typical of the beginning and ending balances of a given period. More sophisticated accounting reporting tools may find a way to automate a company’s average accounts receivable over a given period by factoring in every day ending balances.

View all